30yr Bonds: Market Profile Points of Interest Around the Open

As a TPO Market Profile builds/evolves over time, it provides simple information to use while making trading decisions. Although components to look for are always the same, their significance is different in each situation as there are no two identical trading days. Putting them into context and measuring them continually helps to develop scenarios to execute.

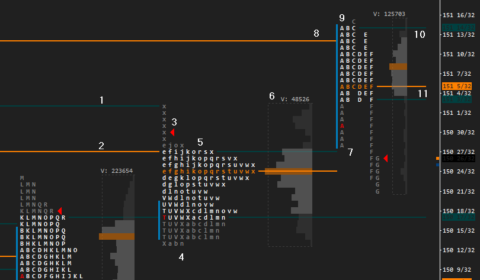

In the below example you can see significant ‘Points of Interests’ during the period d of Globex, Pre-Open, and US Morning Session of 2 Feb 2017.

30yr US Treasury Bonds Market Profile information during the Overnight and US Morning session of 02 Feb 2017

- VAH (Value Area High) of 31 Jan 2017

- TPO POC (Point of Control) of 31 Jan 2017

- Strong Selling Tail during the Pre-Open

- Poor Low of Globex (Night) session

- High-Volume Hold Step in the Volume Profile

- Globex Overnight High

- Initial Balance Range Low – Immediate Rejection Point after the Open

- VPOC (Virgin/Naked POC) of 31 Jan 2017

- Initial Balance High with 1 tick Breakout Failure Pattern

- High-Volume Hold Step in the Volume Profile

- High-Volume Hold Step in the Volume Profile

Last updated: December 8, 2023 at 18:09 pm

Uploads are powered by Proton Drive, MEGA, and Vultr.